The Affordable Care Act (ACA) imposes a penalty on applicable large employers (ALEs) that do not offer health insurance coverage to substantially all full-time employees and dependents. Penalties may also be imposed if coverage is offered, but is unaffordable or does not provide minimum value. The ACA’s employer penalty rules are often referred to as “employer shared responsibility” or “pay or play” rules.

The employer penalty provisions were set to take effect on Jan. 1, 2014. However, in July 2013, the Treasury announced that the employer penalties and related reporting requirements would be delayed for one year, until 2015. Therefore, no penalties will apply to any employers for 2014. Smaller ALEs may also be eligible for an additional one-year delay.

On Feb. 12, 2014, the IRS published final regulations on the employer shared responsibility rules. These regulations finalize provisions in proposed regulations released on Jan. 2, 2013. Under the final regulations, ALEs that have fewer than 100 full-time employees (including full-time equivalents, or FTEs) generally will have an additional year, until 2016, to comply with the pay or play rules. ALEs with 100 or more full-time employees (including FTEs) must comply with the pay or play rules starting in 2015.

The pay or play rules will take effect for most ALEs beginning on Jan. 1, 2015. To prepare for compliance, employers that intend to use the look-back measurement method for determining full-time status for 2015 will need to begin tracking their employees’ hours of service in 2014 to have corresponding stability periods for 2015.

Identifying Full-time Employees

A full-time employee is an employee who was employed on average at least 30 hours of service per week. The final rules treat 130 hours of service in a calendar month as the monthly equivalent of 30 hours of service per week.

The final regulations provide two methods for determining full-time employee status—the monthly measurement method and the look-back measurement method. These methods provide minimum standards for identifying employees as full-time employees. Employers may decide to treat additional employees as eligible for coverage, or otherwise offer coverage more expansively than would be required to avoid a pay or play penalty.

Monthly Measurement Method

The monthly measurement method involves a month-to-month analysis where full-time employees are identified based on their hours of service for each calendar month. This method is not based on averaging hours of service over a prior measurement period. This month-to-month measuring may cause practical difficulties for employers, particularly if there are employees with varying hours or employment schedules, and could result in employees moving in and out of employer coverage on a monthly basis.

Look-back Measurement Method

The look-back measurement method is an optional safe harbor method for determining full-time status that is intended to give employers flexible and workable options and greater predictability for determining full-time employee status. The look-back measurement method involves a measurement period for counting hours of service, a stability period when coverage may need to be provided, depending on an employee’s average hours of service during the measurement period, and an administrative period that allows time for enrollment and disenrollment.

Employers that intend to use the look-back measurement method for determining full-time status for 2015 will need to begin their measurement periods in 2014 to have corresponding stability periods for 2015. However, employers intending to adopt a 12-month measurement period (and, in turn, a 12-month stability period) will face time constraints in doing so.

Consequently, as transition relief, the final regulations allow employers to use shorter measurement periods for stability periods starting in 2015 under the look-back measurement method. For 2015, employers can determine full-time status by reference to a transition measurement period in 2014 that:

- Is shorter than 12 consecutive months, but not less than six consecutive months long; and

- Begins no later than July 1, 2014, and ends no earlier than 90 days before the first day of the first plan year beginning on or after Jan. 1, 2015.

When to Begin Tracking Employee Hours

Calendar Year Plans

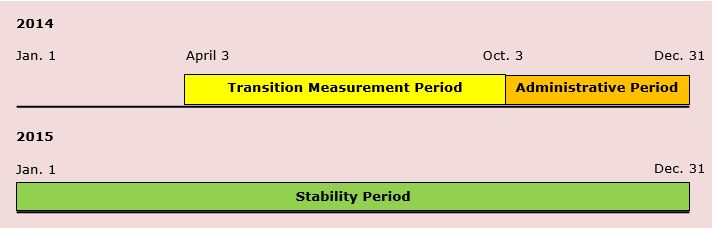

An ALE that wants to use the look-back measurement method may need to start measuring hours of service as early as April 3, 2014. This date would apply if the employer wants to use a 12-month stability period beginning on Jan. 1, 2015, and take advantage of the maximum 90-day administrative period. It can be helpful to work backward to determine the applicable dates.

In this scenario:

- The stability period would run for the entire 2015 calendar year to coincide with the plan year;

- A full 90-day administrative period would run from Oct. 3, 2014, through Dec. 31, 2014; and

- The minimum permissible transition measurement period of six consecutive months would begin on April 3, 2014.

The following chart illustrates this timeline:

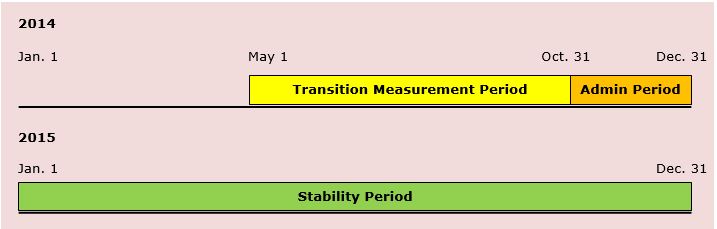

Employers may want to set up the measurement, administrative and stability periods to begin on the first day of the month for administrative ease. This can be accomplished by using a shorter administrative period. Employers would then not have to begin measuring hours of service so early. For example, an employer with a calendar year plan may use the following timelines:

- A transition measurement period from May 1 through Oct. 31, 2014 (six months);

- A 61-day administrative period (the months of November and December) ending on Dec. 31, 2014; and

- A full 12-month stability period from Jan. 1 through Dec. 31, 2015.However, all ALEs that want to take advantage of the shorter transition measurement period in 2014 must begin tracking employee hours no later than July 1, 2014. For a calendar year plan, this would allow for a six-month transition measurement period (running from July 1, 2014, through Dec. 31, 2014), but no administrative period.

- The following chart illustrates this timeline:

Non-calendar Year Plans

In general, the ACA’s pay or play penalty goes into effect on Jan. 1, 2015, for both ALEs with calendar year plans and ALEs with non-calendar year plans. However, the final regulations include transition relief that provides ALEs that have non-calendar year plans with additional time to comply, if certain conditions are met.

Thus, employers that have non-calendar year plans may have some additional time before they need to begin tracking employees’ hours of service. For example, an employer with a plan year beginning April 1 that is using a 90-day administrative period may use a measurement period from July 1, 2014, through Dec. 31, 2014 (six months), followed by an administrative period ending on March 31, 2015.

However, an employer with a plan year beginning on July 1 may not use a six-month transition measurement period. Instead, the employer must use a measurement period that is longer than six months to comply with the requirement that the measurement period begin no later than July 1, 2014, and end no earlier than 90 days before the stability period. For example, the employer may have a 10-month measurement period from June 15, 2014, through April 14, 2015, followed by an administrative period from April 15, 2015, through June 30, 2015.

More Information

Please contact Purpose Employer Solutions for more information, as well as additional resources to help track your employees’ hours of service. Our agents can be reached at (941) 497-7737 or via Email.